Category: Budgeting Your Project

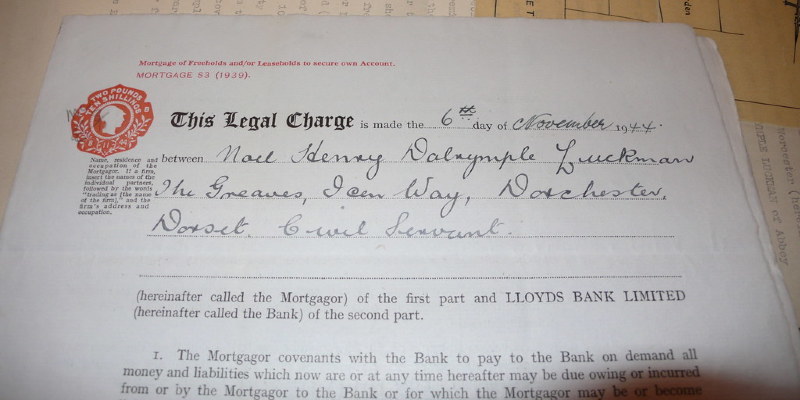

How to Watch Mortgage Rates

October 16, 2020

If you’re considering refinancing or applying for a home mortgage, tracking interest rates can work to your advantage, particularly in the event that you will need the rate to be at a certain degree. Tracking interest rates gives you the opportunity to lock in a low rate. The single drawback is that you don’t want […]

Home Equity Line of Credit Advantages Vs. Disadvantages

October 13, 2020

A home equity line of credit is another mortgage on your home that takes the kind of a line of credit in lieu of a lump sum. The whole loan amount is made available to you, but you choose when and how much to shoot more than a”draw” period–generally 10 years. Over the draw period […]

What Happens If You Get a Foreclosure Notice?

October 30, 2019

In the event you receive a foreclosure notice in the email, it means you have fallen far enough behind on your mortgage payments your lender intends to take your house and sell it off unless you make up payments. Your lender can begin foreclosure if you miss one payment, but many creditors will send an […]

How Can a Short Sale Affect FICO?

October 27, 2019

A short sale of a house occurs when a homeowner successfully sells his house for less than is owed on it. Typically, the mortgage creditor forgives the difference between the selling price and the mortgage balance. However, a short sale has the potential to negatively alter the seller's credit background for a time. The seriousness […]